Last updated:

| 4 min read

As we step into 2024, the dynamic world of cryptocurrencies continues to captivate investors worldwide. Amongst a plethora of options, three stand out for their remarkable performance in the previous year: Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

Bitcoin, a pioneering force in the crypto market, experienced a remarkable surge of 155% in 2023, starting the year at $16,530 and soaring to a close at $42,785. Ethereum, known for its versatile blockchain technology, also saw an impressive growth of 90%, opening at $1,195 and escalating to $2,280 by year’s end.

Solana, a newer but rapidly growing player in the crypto space, astounded many by skyrocketing 919%, from a modest $9.96 to an impressive $101.69. These extraordinary gains highlight their potential as key components in a balanced portfolio.

Let’s delve deeper into their long-term performance and prospects for 2024.

Bitcoin Price Prediction

On the monthly chart, Bitcoin’s stability is reflected in its current valuation at $42,685, supported by a pivot point at $34,213. Resistance levels loom overhead at $47,614, $50,000, and $53,079, while supports are established at $29,079, $26,902, and $25,235.

The Relative Strength Index (RSI) sits at a neutral 51.71, signaling a balance in market sentiment. Despite the chart exhibiting a Double Top pattern—a classic bearish reversal signal—the absence of a subsequent downturn suggests that the pattern has not been activated.

Consequently, the long-term view remains bullish with an anticipation of Bitcoin testing the immediate resistance at $47,614. Vigilance is advised, as a shift in market dynamics could quickly validate the bearish pattern, calling for a reassessment of the current trend.

Ethereum Price Prediction

on the monthly chart paints a bullish picture as it currently trades at $2,503. The cryptocurrency has carved out significant supports at $1,719 and $965, with the pivot point likely situated around the $1,719 mark, serving as a strong psychological level for long-term market participants.

The 50 EMA is trending upward, suggesting a favorable tailwind for Ethereum, while the RSI hovers around 50.53, indicating neither overbought nor oversold conditions, but rather a neutral market stance.

The price has been making higher lows and higher highs, a sign of sustained buying interest and potential continuation of the uptrend.

Taking into account the convergence of the moving averages and the RSI’s neutral position, Ethereum appears poised for further growth.

Market observers should anticipate Ethereum to challenge its next resistance levels at $2,729 and potentially $3,477 in the forthcoming months. As always, vigilance is warranted as any break below the pivotal supports could alter the bullish scenario.

Solana Price Prediction

shows a noteworthy rebound on the monthly chart, currently trading around $23.24. The chart suggests that after a significant drop, the price has found a degree of stability. The pivot point for this recovery is hinted at $34.40, with Fibonacci levels indicating potential resistance at $65.10, $99.43, and $127.17, in ascending order.

The 50-day EMA appears to be providing dynamic support, which could bolster the bullish case for Solana.

Moreover, the RSI indicates increasing momentum with a reading of 51.62, positioned just above the midline, hinting at a growing bullish sentiment among investors.

This technical setup, combined with the price action clearing the $34.40 level, lays the foundation for a potential push towards the first Fibonacci resistance.

The long-term outlook for Solana is cautiously optimistic, with the expectation of it testing higher resistance levels, provided the cryptocurrency market maintains its current trajectory and investor sentiment remains positive.

Emerging Cryptocurrencies for a High-Reward Portfolio

Investors with an appetite for volatility and substantial returns might look towards the latest buzz in the crypto pre-sale market, where eye-catching staking APYs are on full display.

Daring Investment Opportunity: Launchpad XYZ

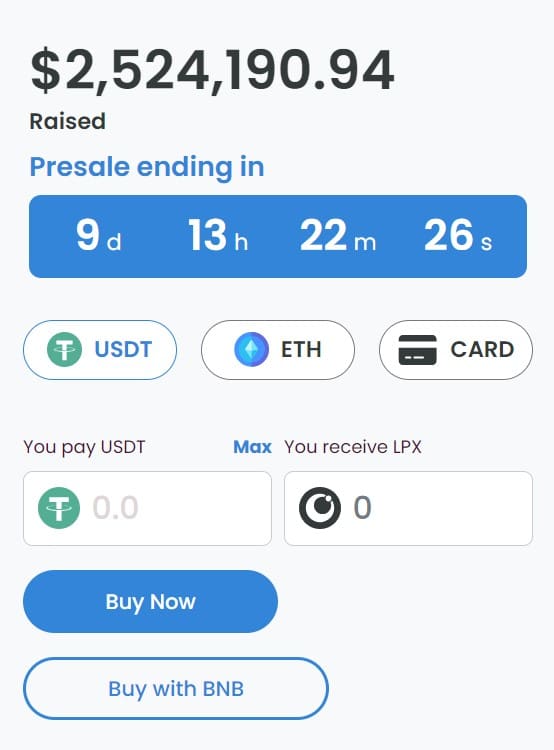

Launchpad XYZ’s presale fervor is undeniable, with a remarkable $2.52 million already raised and the countdown ticking towards 9 days remaining. The platform stands out in the Web3 sphere, not just as a trading platform but as an educational hub.

It simplifies the complex universe of Web3 into a comprehensive learning environment, providing traders at all levels with the tools and knowledge to maximize their potential.

The presale offers tiered entry points, from the Doge Level at $50, providing weekly summaries and community access, to the elite Elon Level for professional traders, priced at $25,000+, which includes exclusive insights and direct engagement with founders.

Key trades on the platform show significant returns, with ELON 2.0 yielding a 29x profit and WAGIEBOT an 11x profit, showcasing the platform’s potent trade insights.

Launchpad XYZ is not just about trades but about understanding market movements and leveraging their proprietary LPQ system for informed decision-making.

With Apollo, their custom AI, and a focus on demystifying Web3, Launchpad XYZ is poised to onboard the next wave of savvy investors. Join now and be part of this transformative journey in cryptocurrency investment.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Read More

Johnathon Redner