When it comes to tackling the biggest culprits for embodied carbon in the built environment, silver bullets are in short supply. By Kristina Smith

The construction industry is awash with decarbonisation roadmaps and plans for achieving net-zero carbon emissions by 2050. Most have milestone goals set at 2030 – an increasingly tight deadline.

With operational carbon emissions in the built environment already on a downward trajectory, attention has turned to the thornier issue of embodied carbon. And for almost any construction project, the big hitters are concrete and steel. Cement production is responsible for about 7 per cent of the world’s carbon emissions, while steelmaking accounts for between 7 and 9 per cent, around half of which goes into construction.

But the challenge for such plans is that we are heading into uncharted territory, which means imagination, optimism and even some wishful thinking may have been deployed in the mapmaking.

Some measures for embodied-carbon reduction, such as more efficient design and lower levels of waste, are understood and underway. Others are less defined; changes to processes or chemistry are at various stages of development. And then there is carbon capture, usage and storage (CCUS), which all concrete and steel roadmaps rely on heavily. For this section of the journey, the view ahead is far from clear.

STEEL: THE UK IS LAGGING BEHIND

On the Allerdene Bridge, which carries the A1 between Birtley to Coal House over the East Coast Main Line railway, Severfield used bespoke steel stools, stubs and packers for the temporary works, all of which were dismantled and will be reused on future projects

Developers and specifiers who are calling for low-carbon steel today may be decelerating rather than accelerating the journey to net-zero carbon emissions. That is the warning from Dr Michael Sansom, sustainability manager at the British Constructional Steelwork Association (BCSA), a recognised expert on this topic.

Lower-carbon steel comes from the electric arc furnace (EAF) method, which is used to turn scrap steel into steel products and is far less carbon-intensive than the blast furnace-basic oxygen furnace (BF-BOF) route used to make steel from iron ore. The challenge is that there just isn’t enough scrap steel to go around. If developed economies such as the UK sucked up all the secondary steel supply, where would that leave booming markets in the developing world?

“Unless we help them to decarbonise primary steelmaking, we’re not going to get where we need to be,” says Sansom. “Developed economies almost have a moral obligation to lead on this, given we have been pumping carbon into the atmosphere since we first made steel in the UK 200 years ago.”

Unpacking the complexity

The BCSA’s 2050 decarbonisation roadmap, published in 2021, outlines six areas for carbon-emissions reduction and estimates how much each of them could contribute. The two biggest cuts are attributed to changes in the steelmaking process (28 per cent) and CCUS (25 per cent), with more-efficient design, steel reuse, steel transport, fabrication and erection, and decarbonisation of the electricity grid all contributing smaller proportions.

For more insight into the complexities of steel decarbonisation, there’s the Mission Possible Partnership’s Making Net-Zero Steel Possible roadmap, which looks at various technical and political scenarios. It concludes that a global investment of between $170bn and $200bn (£130bn-£155bn) in technology for steelmaking and CCUS will be needed annually to get to net zero by 2050.

Low-carbon technology to extract iron from ore does exist, but scaling it up will be costly. The direct reduced-iron (DRI) process, using green hydrogen, deploys hydrogen rather than carbon from coal in the chemical reaction to extract iron. But it requires huge amounts of hydrogen made using electrolysis of water with renewable electricity. Sweden’s Hybrit has developed a hydrogen DRI process that it could commercialise within a couple of years. Hybrit is one of many steel-decarbonisation projects underway in Europe, thanks to the EU’s ‘Fit for 55’ legislation package to achieve a 55 per cent reduction in carbon emissions by 2030. Eurofer, the European Steel Association, currently lists 60 projects on its live map.

“The government seems to have a real hesitancy in following down the same path [as the EU on decarbonisation]. If the legislation comes, the investment will follow”

Michaela Lindridge, Severfield

Since most UK steel is made using the BF-BOF method, steel fabricators such as Severfield have to source their low-carbon steel from Europe. “Although we source some of our steel from Europe because they have better availability of low-carbon steel, we would obviously prefer to source it locally, but that’s not an option at this time,” says Michaela Lindridge, the company’s head of environmental, social and governance.

Severfield bought Dutch firm Voortman in April this year. “In the Netherlands, they have access to more EAF steel and utilise renewable energy, and they are expanding the electricity networks to be able to support demand and support steel manufacture,” says Lindridge. “It’s very progressive; it’s moving faster than in the UK, but there’s a real hope we can do that here.”

The UK is taking strides in some areas. Liberty Steel has successfully trialled Ecoke, which contains processed organic materials that reduce emissions by about 30 per cent, in the EAF process.

London’s office market is pushing to reuse steel sections sourced from demolition projects. This idea, pioneered by Roy Fishwick, managing director at Cleveland Steel, is now being commercialised by EMR, a metal-recycling company that operates in the UK, US and Europe.

“What we source and have on the ground, we could sell 50 or 60 times, so we have to accelerate the supply,” says Bill Firth, who heads up the reusable steel business at EMR. “We are working with asset owners, developers, engineers, to look at the early engagement process around structures that are being demolished.” Reused steel sections to the tune of 500 or 600 tonnes will be going into five or six London projects this year, according to Firth.

Political resolve is lacking

One of the biggest frustrations for Severfield and fellow BCSA members is that European policymakers are driving change far faster than those in the UK. “The government and the private sector in Europe are focusing on decarbonisation of the industry,” says Lindridge. “There’s a little bit of frustration in the UK because the government seems to have a real hesitancy in following down the same path. If the legislation comes, the investment will follow.”

The UK’s two biggest steel producers, Chinese-owned British Steel and India’s Tata, both of which use the BF-BOF process, were promised £600m towards decarbonisation by the UK government in early 2023, as long as they guaranteed UK jobs. But that is nowhere near enough, says Lindridge.

Without more investment, the UK’s focus on low-carbon construction projects could hasten the demise of what is left of the UK steelmaking industry – and leave the work of decarbonising primary steelmaking to others.

CONCRETE: MIXED GLOBAL PRIORITIES

China United Cement Corporation’s cement plant in Tai’An, China, has a 1.1 million tonnes per annum capacity and is highly energy-efficient, producing 70 per cent fewer emissions than the national average, according to the World Cement Association

The reason why concrete – or, to be more specific, clinker cement – is such a big hitter in carbon-emissions terms is that its production generates carbon on two fronts: heating up the kiln contributes about one-third of the emissions and the chemical reaction itself accounts for two-thirds.

“The Chinese government brought in new energy-efficiency standards last year, which we estimate only a third of cement producers could meet, and they have three years to do so”

Ian Riley, World Cement Association

Cement decarbonisation roadmaps envisage a mix of fuel-switching at cement plants; new concrete mixes, such as those containing supplementary cementitious materials (SCMs); decarbonisation of the electricity grid; and decarbonised transport. In the UK, the Mineral Products Association’s (MPA’s) 2020 roadmap – which also has a 2050 net-zero target – estimates 61 per cent of 2020-2050 carbon reduction will come from carbon capture, usage and storage (CCUS). Meanwhile, the Global Cement and Concrete Association’s (GCCA) 2021 to net zero by 2050 roadmap cites a figure of 36 per cent.

That difference in proportions illustrates that some countries are further along the road than others. The UK has reduced its emissions by just over 50 per cent since 1990, according to the MPA, while the GCCA’s members achieved a 20 per cent cut in emissions between 1990 and 2020, and are targeting a further 20 per cent by 2030. “Everyone would like it to be more, but that’s an incredibly challenging global target,” says Dr Andrew Minson, the GCCA’s concrete and sustainable construction director.

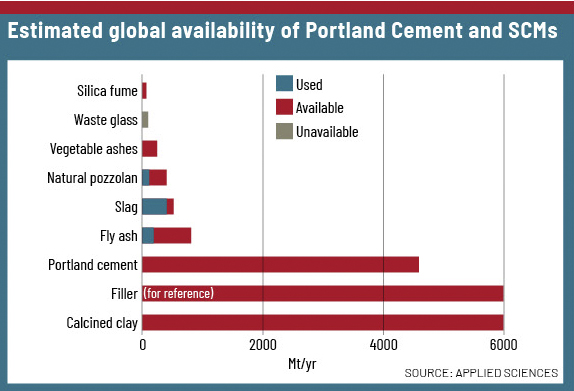

The 20 per cent global cut could be achieved by spreading practices established in Europe around the world, says Minson, namely, the use of SCMs such as ground granulated blast-furnace slag (GGBS), pulverised fuel ash (PFA) and calcined clay to reduce the clinker content in cement and concrete, while using fuels from waste to heat the kiln. “These two levers globally are underutilised,” says Minson.

Impact of China

Ian Riley, chief executive of the World Cement Association, points out that one of the big challenges in reducing carbon emissions globally is that some developing countries face more pressing challenges. China, which represents 55 per cent of global cement demand and production, is the most acute example of this. “Last year, with a reduction in demand of over 10 per cent, prices collapsed and most Chinese cement manufacturers are struggling to make money from the cement business,” says Riley. “For the majority of manufacturers, the major priority is getting their businesses back on a viable basis.”

China is already ahead on plant energy efficiency due to government regulation. Riley says: “The Chinese government brought in new energy-efficiency standards last year, which we estimate only a third of cement producers could meet, and they have three years to do so. There would be very few plants in Europe that would meet those standards.”

Using more SCMs globally will require new SCMs to be developed, with many cement manufacturers moving into calcined clay production. Since GGBS and PFA are by-products of fossil fuel-powered processes, their availability will decline and GGBS will be in shorter supply. GGBS has been used for many years to lower the heat of hydration, and hence reduce the likelihood of cracking, in large concrete pours. Riley comments that it might be better to deploy it for its technical performance rather than for showboating on low-carbon projects.

Technological firsts

Among the developments in SCM is a technology called ACT from Dublin-based Ecocem, which allows the use of whatever cementitious material is available locally. ACT cement contains higher proportions of limestone filler than a standard cement and between 15 and 25 per cent clinker – compared with 70-80 per cent in conventional cements – along with an SCM and a special admixture.

Meanwhile, Recycl8, set up by entrepreneur Ian Skene in the North East, is working with incinerator bottom ash (IBA), a by-product from burning waste, which is ground into granules and used as a substitute for virgin aggregate. The firm is currently patenting a process that uses carbon dioxide absorbed from the atmosphere to turn any metals in the ground IBA into carbonates, preventing them from leaching out of the cement later. A trial using 15 per cent IBA to replace aggregate and 30 per cent less cement resulted in concrete that reached C35 strengths, according to Skene.

CCUS projects are ramping up, too, in regions where legislation is driving it. Minson welcomes recent moves on CCUS by the EU, US and Canadian governments. Cement manufacturers have responded with announcements, such as that of Heidelberg in April 2023, which promised to open a carbon capture plant in Germany by 2026 and outlined plans for a similar scheme in Canada.

For cement producers, it’s a balancing act between investing in shorter-term technologies to hit 2030 targets and solving the long-term problems. “Investing in CCUS is spending a lot of money on projects that take a long time to build and won’t have much impact by 2030,” says Riley. “We have to find a balance [between] progress by 2030, the long term, and the fact that the earlier we do things, the bigger the impact on carbon reduction will be.”

Listen to experts discussing the challenges of decarbonising steel and concrete in the first episode of First Site, the Construction News podcast in partnership with Speedy. CN editor Colin Marrs is joined by Ian Riley, chief executive of the World Cement Association, and Dr Michael Sansom, sustainability manager at the British Constructional Steelwork Association.

Listen to experts discussing the challenges of decarbonising steel and concrete in the first episode of First Site, the Construction News podcast in partnership with Speedy. CN editor Colin Marrs is joined by Ian Riley, chief executive of the World Cement Association, and Dr Michael Sansom, sustainability manager at the British Constructional Steelwork Association.

constructionnews.co.uk/podcast

Read More

Contributor